Investigating the Joint Impact of Exchange Rate and Foreign Direct Investment Inflows on Domestic Interest Rate in Nigeria

Abstract

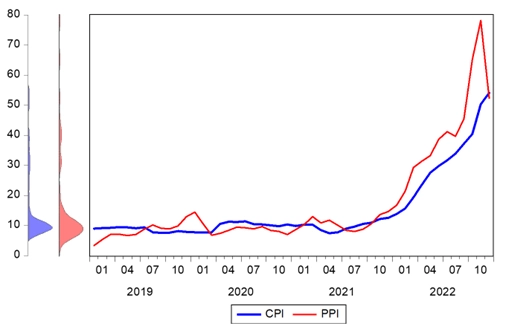

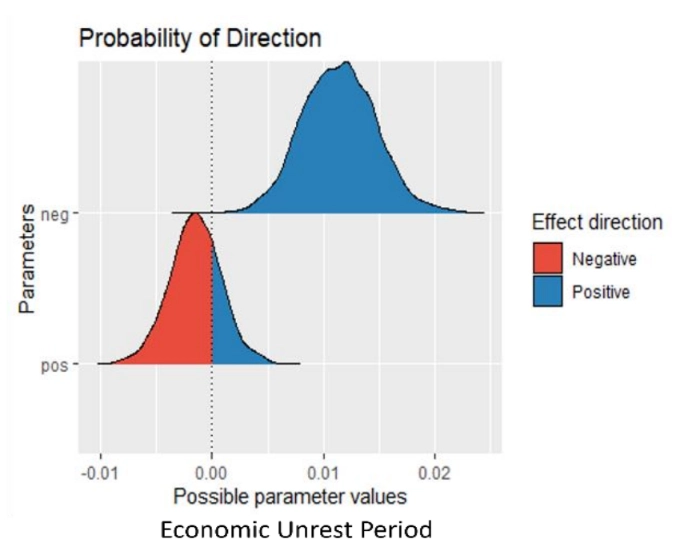

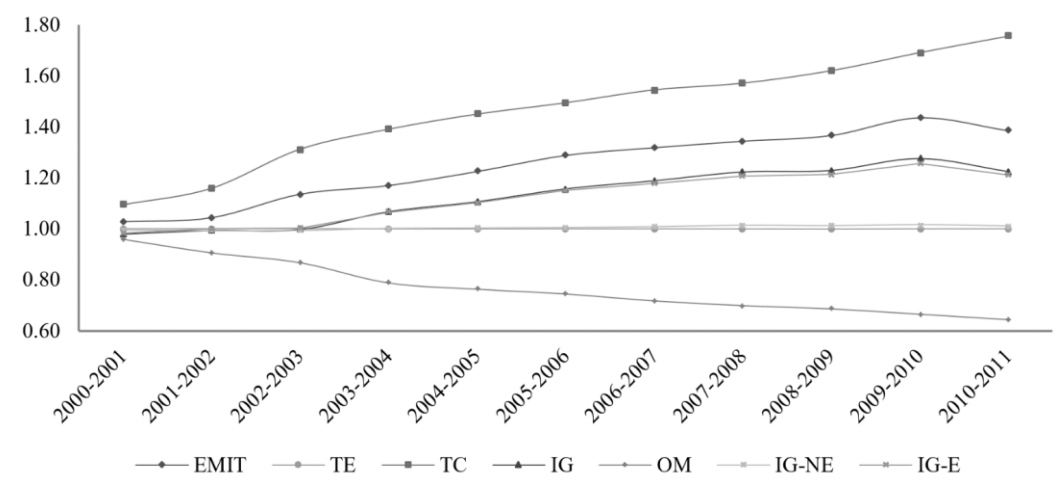

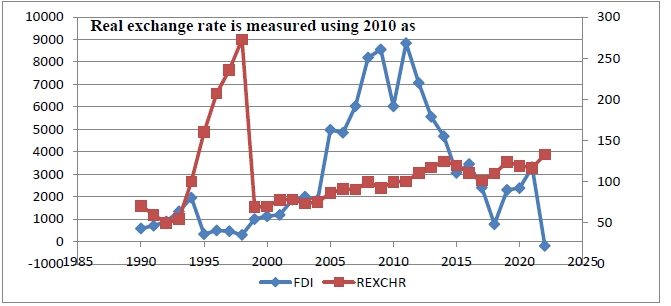

The sensitive nature of interest rate has spurred empirical interests on the factors that determine it. This paper examined the joint impact of exchange rate and foreign direct investment inflows on interest rate in Nigeria over the period from 1981-2022. The study made use of the auto regressive distributed lag (ARDL) bounds test and results of findings reveal that in both the short-run and the long-run the impact of the interaction between FDI inflows and exchange rate on real interest rate was negative and significant. Also, while credit to the private sector was found to have significant positive impact on real interest rate in both the time horizons, the impact of consumer price index was negative only in the short. Oil revenue was found to impact positively on real interest rate only in the long-run, but the impact of broad money supply was negative and significant in both the short-run and the long-run. The study suggests that policies to regulate domestic interest rate should focus on joint regulation of both exchange rate and FDI inflows and this requires a synergy between monetary and fiscal policies.

Cite This Paper

Nzeh, I. C., Nwogwugwu, U. C., Uzonwanne, M. C., Kalu, C. U., & Akalazu, E. C. (2024). Investigating the Joint Impact of Exchange Rate and Foreign Direct Investment Inflows on Domestic Interest Rate in Nigeria. Financial Economics Letters, 3(2), 26. doi:10.58567/fel03020001

Nzeh, I. C.; Nwogwugwu, U. C.; Uzonwanne, M. C.; Kalu, C. U.; Akalazu, E. C. Investigating the Joint Impact of Exchange Rate and Foreign Direct Investment Inflows on Domestic Interest Rate in Nigeria. Financial Economics Letters, 2024, 3, 26. doi:10.58567/fel03020001

Nzeh I C, Nwogwugwu U C, Uzonwanne M C et al.. Investigating the Joint Impact of Exchange Rate and Foreign Direct Investment Inflows on Domestic Interest Rate in Nigeria. Financial Economics Letters; 2024, 3(2):26. doi:10.58567/fel03020001

Nzeh, Innocent C.; Nwogwugwu, Uche C.; Uzonwanne, Maria C.; Kalu, Christopher U.; Akalazu, Emmanuel C. 2024. "Investigating the Joint Impact of Exchange Rate and Foreign Direct Investment Inflows on Domestic Interest Rate in Nigeria" Financial Economics Letters 3, no.2:26. doi:10.58567/fel03020001

Show Figures

Funding

Share and Cite

Article Metrics

References

- Adebayo, T. S., Abolaji, A., Akinsola, G. D, and Olanrewaju, V. O. (2020). Asymmetric Impact of Inflation on Foreign Direct Investment in Nigeria: An Application of the Non-linear Autoregressive Distributed Lag (NARDL) Model. Timisoara Journal of Economics and Business, 13(2), 87-106. https://www.tjeb.ro/index.php/tjeb/article/view/338

- Adrian, T. (2018). Policy responses to capital flows. Speech delivered at LIII Meeting of Governors of Latin America, Spain and the Philippines at the IMF-World Bank Annual Meetings in Bali, Indonesia, October 11. Retrieved from https://www.imf.org/en/News/Articles/2018/11/15/sp101118-policy-responses-to-capitalflows.

- Adu, B. E. and Ntim, A. L. (2014). Causality Analysis of Foreign Direct Investment, Exchange Rate and Interest Rate Volatility in Ghana. Journal of economics and sustainable development, 5, 17-25. https://www.iiste.org/Journals/index.php/JEDS/article/view/13208

- Akanji, O. O. (2006). The Achievement of Convergence in the Nigeria Foreign Exchange Market, Bullion, 30(3), Article 2. https://dc.cbn.gov.ng/bullion/vol30/iss3/2/

- Akinlo, A. E. and Onatunji, O. G. (2021). Exchange Rate Volatility and Foreign Direct Investment in Selected West African Countries. The International Journal of Business and Finance Research, 15(1), 77-88.

- Akpan, E. O. and Atan, J. A. (2012). Effect of Exchange Rate Movements on Economic Growth in Nigeria. CBN Journal of Applied Statistics, 2 (2). 1-14. https://www.semanticscholar.org/paper/Effects-of-exchange-rate-movements-on-economic-in-Akpan-Atan/fc62ee384b02c576e892db41b70b03978799a6d6

- Ali, S. and Nazar, R. (2017). Impact of Foreign Capital Inflows and Money Supply on Exchange Rate: A Case Study of Pakistan. Review of Economics and Development Studies, 3(1), 83-90.

- Aliber, R. Z. (1970). A theory of direct foreign investment. In C. P. Kindleberger, The International Corporation, a symposium. Combrite MA: MIT Press.

- Andrieș, A. M., Căpraru, B., Ihnatov, I. and Tiwari, A. K. (2017). The Relationship between Exchange Rates and Interest Rates in a Small Open Emerging Economy: The Case of Romania. Economic Modelling, 67, 261-274. https://doi.org/10.1016/j.econmod.2016.12.025

- Aribatise, A., Adeyemi, G. and Adeseke, A. S. (2019). The Causal Relationship between Foreign Direct Investment and Exchange Rate In Nigeria (1986-2017). International Journal of Innovative Finance and Economics Research 7(2):67-75.https://www.semanticscholar.org/paper/The-Causal-Relationship-Between-Foreign-Direct-And-Aribatise-Adeyemi/9a1728e488004a6f672552ccbfcad72ed4cd6eac

- Bentzen, J. & T. Engsted (2001). A revival of the autoregressive distributed lag model in estimating energy demand relationships. Energy, 26(1), 45–55. https://doi.org/10.1016/S0360-5442(00)00052-9

- Cambazoğlu, B. and Güneş, S. (2016). The Relationship between Foreign Exchange Rate and Foreign Direct Investment in Turkey. Economics, Management, and Financial Markets 11(1), 284-293. https://core.ac.uk/download/pdf/250317807.pdf

- Central Bank of Nigeria, CBN (2006). Statistical Bulletin and Annual Report.

- Ding, S., Pan, Q., Zhang, Y., Zhang, J., Yang and Luan, J. (2023). Study on the China’s Real Interest Rate after Including Housing Price Factor into CPI. PLoS One, 18(8), e0290079.

- Faroh, A. and Shen, H. (2015). Impact of Interest Rates on Foreign Direct Investment: Case Study Sierra Leone Economy. International Journal of Business Management and Economic Research, 6(1), 124-132.

- Idoko. I. A., Eche, E. and kpeyol, K. (2020). An Assessment of the Impact of Interest Rates Deregulation on Economic Growth in Nigeria. International Journal of Economics, 14(2), 143-156.

- Ikhinde, S, I. and Alawode, A. A. (2001). Financial Sector Reforms, Micro Economic Instability and the Order of Economic Liberation: The Evidence from Nigeria. African. Economic Research Paper No 112.

- Isiaka, N. A., Osifalujo, B. B. and Taiwo, O. K. (2022). Interest Rate and Foreign Direct Investment in Sub-Sahara African Countries: The Comparison between Asymmetric and Symmetric Effects (ARDL and NARDL approach). International Journal of Economics, Social Science, Entrepreneurship and Technology, 1(3), 186-200.

- Kilicarslan, Z. (2018). Determinants of Exchange Rate Volatility: Empirical Evidence for Turkey. Journal of Economics, Finance and Accounting,.5(2), 204-213. http://dx.doi.org/10.17261/Pressacademia.2018.825

- Mannathoko, I. (2020). Sterilization in Botswana: Cost, Sustainability and Efficiency. Policy Review No 690.

- Mokuolu J. O. (2018). Effect of Exchange Rate and Interest Rate on FDI and its Relationship with Economic Growth in Nigeria. European Journal of Economic and Financial Research, 3(1), 33-47.

- Mostafa, M. M. (2020). Impacts of Inflation and Exchange Rate on Foreign Direct Investment in Bangladesh. International Journal of Science and Business, 4(11), 53-69. https://ijsab.com/volume-4-issue-11/3282

- Narayan, P. K. (2005). The saving and investment nexus for China: Evidence from co-integration tests. Applied Economics, 37(17), 1979-1990.

- Nwagu, K (2023). The Impact of Macroeconomic Variables on Foreign Direct Investment in Nigeria. Journal of Accounting, Business and Finance Research, 16(1), 30-35.

- Ojinma, D. and Emerenini, F. M. (2015). Impact of Interest Rate on Investment in Nigeria. Journal of Developing Countries, 5(3), 103-109.

- Okoye, L. U., Nwakoby, C. I. N. and Modebe, N. J. (2015). Interest Rate Reform and Real Sector Performance: Evidence from Nigeria. African Banking and Finance Review, 2(1), 97-114.

- Okoukoni, V. and Oyekan, M. (2023). Nigeria’s Floating Exchange Rate Regime: Potential Tax Implications and Management Strategies for Businesses. BusinesDay, Tuesday, August, 2023. Retrieved from: https://ng.andersen.com/nigerias-floating-exchange-rate-regime-potential-tax-implications-management-strategies-for-businesses/

- Onakoya, A. B. and Agunbiade, O. A. (2020) Oil Sector Performance and Nigerian Macroeconomic Variables. International Journal of Economics, Management and Accounting 28(1), 35-62.

- Otiwu, K. C. (2018). Foreign Exchange Rate Policies and Economic Growth Nexus in Nigeria. Emerald International Journal of Scientific and Contemporary Studies, 1(1), 84-112.

- Pesaran, M. & Shin, Y. (1999). An Autoregressive Distributed-lag Modelling Approach to Co- integration Analysis. Cambridge: Cambridge University Press.

- Qabhobho, T., Amoah, E. V. and Doku, I. (2022). Linkages between Foreign Direct Investment, Trade Openness and Economic Growth in South Africa: Does Exchange Rate Regime Choice Matter? Latin American Journal of Trade Policy, 13, 60-86. https://doi.org/10.5354/0719-9368.2022.66007

- Rehman, H. U., Ahmed, D. I., and Jaffri, D. A. A. (2020). Impact of Foreign Direct Investment (FDI) Inflows on Equilibrium Real Exchange Rate of Pakistan. South Asian Studies, 25(1), 125-141.

- Rufai, A. A., Aworinde, O. B. and Ajibola, O. (2022). Impact of FDI on Exchange Rate in Nigeria: A Combined Cointegration Approach. Journal of Economics and Allied Research, 7(1), 141-158.

- Tan, L., Xu, Y. and Gashaw, A. (2021). Influence of Exchange Rate on Foreign Direct Investment Inflows: An Empirical Analysis based on Co-integration and Granger Causality Test. Hindawi Mathematical Problems in Engineering Volume 2021. Retrieved from: https://doi.org/10.1155/2021/7280879.

- Zhao, Y., Li, X., and de Haan, J. (2022). The Time Varying Causal Relationship between International Capital Flows and the Real Effective Exchange Rate: New Evidence for China. The Singapore Economic Review, 67(4), 1253-1274. https://doi.org/10.1142/S0217590819500097