A pipeline between producer and consumer prices in Ghana: A Policy Issue

Abstract

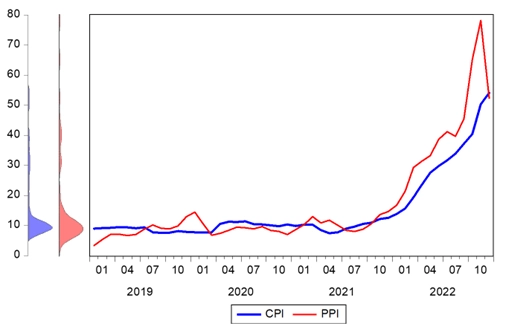

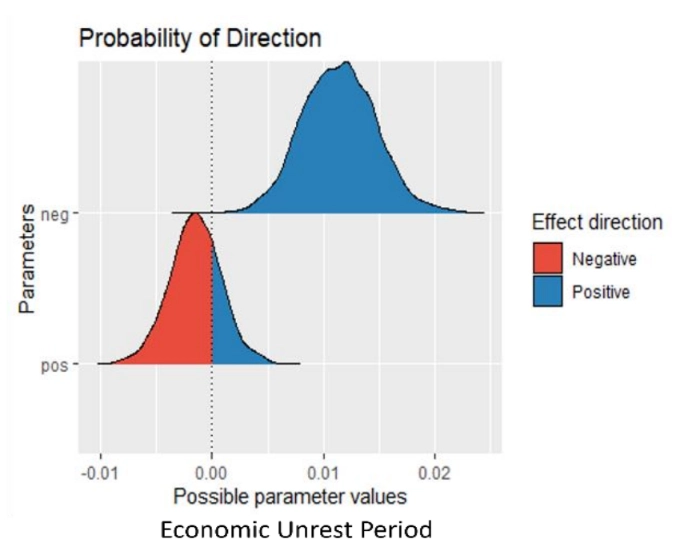

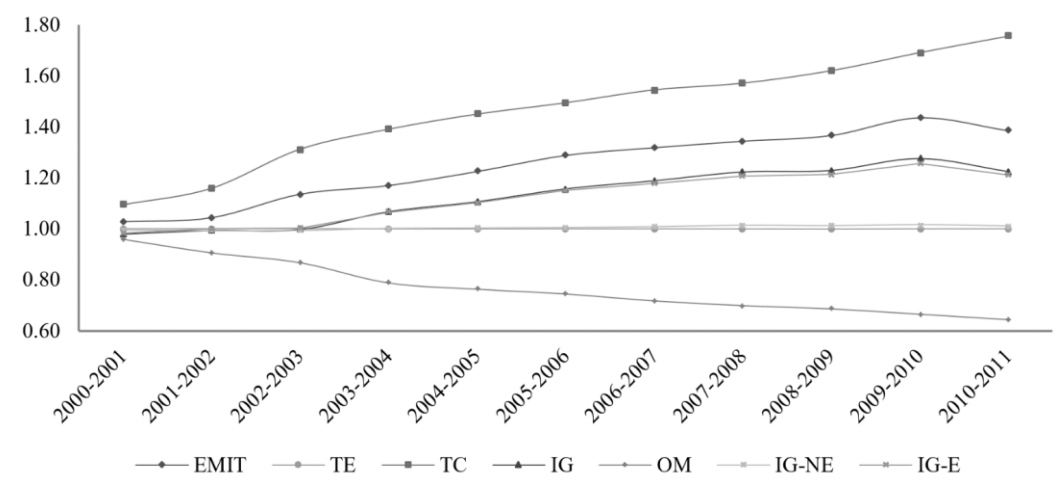

As prices have grown at their fastest pace in recent times, inflation has become a key concern for the macro-policy environment. In many jurisdictions, consumer prices have typically formed the basis for price stability policies. Notwithstanding, producer prices remain an important channel and must be closely watched. We utilise data on Ghana and investigate the causal links between consumer and producer inflation and assess the necessity to include producer inflation target in the monetary policy rule. Our VECM and Granger causality analyses show that consumer and producer prices exhibit very stable long-term relationship and short-term gaps between the two tend to normalise over time. The relationship between consumer and producer prices has not been a one-sided lag structure, even though producer prices lead more than lag consumer prices. We conclude that Bank of Ghana’s monetary policy design that does not distinguish between consumer and producer inflation is less problematic at the moment.

Cite This Paper

Ahiadorme, J. W., & Akoto, L. (2023). A pipeline between producer and consumer prices in Ghana: A Policy Issue. Financial Economics Letters, 2(3), 17. doi:10.58567/fel02030002

Ahiadorme, J. W.; Akoto, L. A pipeline between producer and consumer prices in Ghana: A Policy Issue. Financial Economics Letters, 2023, 2, 17. doi:10.58567/fel02030002

Ahiadorme J W, Akoto L. A pipeline between producer and consumer prices in Ghana: A Policy Issue. Financial Economics Letters; 2023, 2(3):17. doi:10.58567/fel02030002

Ahiadorme, Johnson W.; Akoto, Linda 2023. "A pipeline between producer and consumer prices in Ghana: A Policy Issue" Financial Economics Letters 2, no.3:17. doi:10.58567/fel02030002

Show Figures

Share and Cite

Article Metrics

References

- Akcay, S. (2011). The causal relationship between producer price index and consumer price index: Empirical evidence from selected European countries. International Journal of Economics and Finance, 3(6), pp.227-232. https://doi.org/10.5539/ijef.v3n6p227

- Caporale, G.M., Katsimi, M. and Pittis, N. (2002). Causality links between consumer and producer prices: some empirical evidence. Southern Economic Journal, 68(3), pp.703-711. https://doi.org/10.1002/j.2325-8012.2002.tb00448.x

- Cushing, M.J. and McGarvey, M.G. (1990). Feedback between wholesale and consumer price inflation: A reexamination of the evidence. Southern Economic Journal, pp.1059-1072. https://doi.org/10.2307/1059891

- De Paoli, B. (2009). Monetary policy and welfare in a small open economy. Journal of international Economics, 77(1), pp.11-22. https://doi.org/10.1016/j.jinteco.2008.09.007

- Gali, J. and Monacelli, T. (2005). Monetary policy and exchange rate volatility in a small open economy. The Review of Economic Studies, 72(3), pp.707-734. https://doi.org/10.1111/j.1467-937X.2005.00349.x

- Gang, F.A.N., Liping, H.E. and Jiani, H.U. (2009). CPI vs. PPI: Which drives which?. Frontiers of Economics in China, 4(3), pp.317-334. https://doi.org/10.1007/s11459-009-0018-z

- Hamid, S., Thirunnavukkarasu, A., and Rajamanickam, M. (2006). Transmission Between Djia, S&P 500 Index, PPI And CPI. CFS Working Paper Series, 2006-05.

- Huang, K.X. and Liu, Z. (2005). Inflation targeting: What inflation rate to target?. Journal of Monetary Economics, 52(8), pp.1435-1462. https://doi.org/10.1016/j.jmoneco.2004.08.008

- Jongwanich, J., Park, D. and Wongcharoen, P. (2019). Determinants of Producer Price versus Consumer price inflation in emerging Asia. Journal of the Asia Pacific Economy, 24(2), pp.224-251. https://doi.org/10.1080/13547860.2019.1574251

- Khan, K., Su, C.W., Tao, R. and Lobonţ, O.R. (2018). Producer price index and consumer price index: Causality in central and Eastern European countries. Ekonomicky Casopis, 66(4), pp.367-395. http://hdl.handle.net/11159/3932

- Li, S., Tang, G., Yang, D. and Du, S. (2019). Research on the Relationship between CPI and PPI Based on VEC Model. Open journal of statistics, 9(02), p.218. https://doi.org/10.4236/ojs.2019.92016

- Lombardo, G. and Ravenna, F. (2014). Openness and optimal monetary policy. Journal of International Economics, 93(1), pp.153-172. https://doi.org/10.1016/j.jinteco.2014.01.011

- Martinez, W.O., Caicedo, E.G. and Tique, E.J. (2013). Exploring the Relationship between the CPI and the PPI: The Colombian Case. International Journal of Business and Management, 8(17), p.142. http://dx.doi.org/10.5539/ijbm.v8n17p142

- Nilcan, M.E.R.T. (2023). Transmission Mechanism between Consumer and Producer Prices in Fragile Five Countries: Threshold Cointegration and Error Correction. Hacettepe Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 41(2), pp.251-270. https://doi.org/10.17065/huniibf.1137805

- O'Trakoun, J. and Ramachandran, D. (2022). Building A Pipeline Between Producer and Consumer Prices. Richmond Fed Economic Brief, 22(38)

- Ozpolat, A. (2020). Causal link between consumer prices index and producer prices index: An Evidence from central and Eastern European Countries (CEECs). Adam Academy Journal of Social Sciences, 10(2), pp.319-332. https://doi.org/10.31679/adamakademi.594508

- Rubene, I. (2023). Indicators for producer price pressures in consumer goods inflation. Economic Bulletin Boxes, 3

- Shahbaz, M., Wahid, A.N. and Haider, A. (2010). Empirical psychology between wholesale price and consumer price indices: the case of Pakistan. The Singapore Economic Review, 55(03), pp.537-551. https://doi.org/10.1142/S0217590810003882

- Su, C.W., Khan, K., Lobont, O.R. and Sung, H.C. (2016). Is there any relationship between producer price index and consumer price index in Slovakia? A bootstrap rolling approach 1. Ekonomicky Casopis, 64(7), p.611

- Ulke, V. and Ergun, U. (2014). The relationship between consumer price and producer price indices in Turkey. International Journal of Academic Research in Economics and Management Sciences, 3(1), pp.205-222. https://dx.doi.org/10.6007/ijarems/v3-i1/607

- Wei, S.J. and Xie, Y. (2020). Monetary policy in an era of global supply chains. Journal of International Economics, 124, p.10329.9 https://doi.org/10.1016/j.jinteco.2020.103299

- Wei, S.J. and Xie, Y. (2022). On the wedge between the PPI and CPI inflation indicators (No. 2022-5). Bank of Canada Staff Working Paper. https://doi.org/10.34989/swp-2022-5