Economic Unrest and Investment Perspective on Liquidity in relation to the Investor Sentiments

Abstract

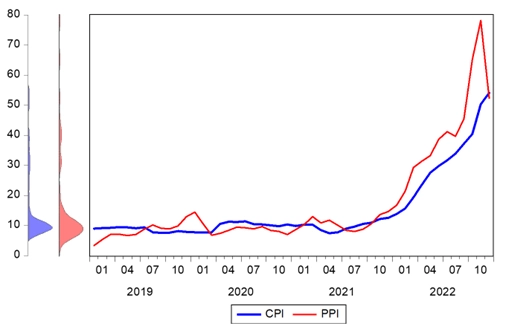

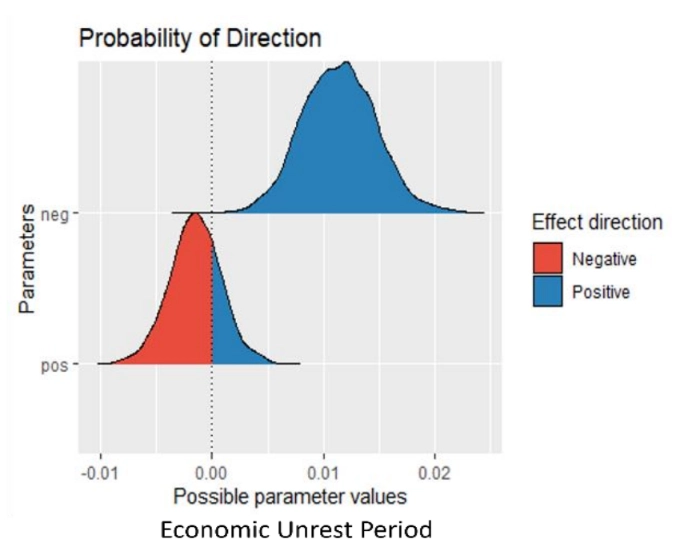

Liquidity and its associated issues are one of dominant strands in the market microstructure. In this study, microblogging-based behavioral perspective on economic unrest is linked to the market liquidity. The concept of liquidity is examined in terms of price dispersion relative to the quantity traded. The analysis contains the quantification of multiple linear regression, Gaussian distribution technique, and vector error correction methodology. In the economic stability period, the investor’s mood, either in positive manner or pessimistic context, had an influential role on the price impact volume-based liquidity. Meantime, the probability was higher for occurrence of price impact volume-based liquidity in response to the sentiment indicators. In the economic unrest environments, the positive bias investor’s mood was not vigorous enough to influence the dispersion of asset’s prices and trading quantity. Most importantly, the negative bias investor’s emotion was linked to increase the dispersion of asset’s prices relative to the quantity traded. Investors with a lower amount of trading quantity had declined the liquidity in the market. Additionally, there was a higher probability for occurrence of illiquidity in the pessimistic market periods. However, changes in past sentiment series were not associated with changes in pervious liquidity series, either in short run or long run. The findings may be potentially applicable to manage the behavioral perspective of liquidity risk.

Cite This Paper

Saleemi, J. (2023). Economic Unrest and Investment Perspective on Liquidity in relation to the Investor Sentiments. Financial Economics Letters, 2(2), 15. doi:10.58567/fel02020005

Saleemi, J. Economic Unrest and Investment Perspective on Liquidity in relation to the Investor Sentiments. Financial Economics Letters, 2023, 2, 15. doi:10.58567/fel02020005

Saleemi J. Economic Unrest and Investment Perspective on Liquidity in relation to the Investor Sentiments. Financial Economics Letters; 2023, 2(2):15. doi:10.58567/fel02020005

Saleemi, Jawad 2023. "Economic Unrest and Investment Perspective on Liquidity in relation to the Investor Sentiments" Financial Economics Letters 2, no.2:15. doi:10.58567/fel02020005

Show Figures

Share and Cite

Article Metrics

References

- Amihud, Y. (2002). Illiquidity and stock returns cross-section and time-series effects. Journal of Financial Markets 5(1), 31-56. https://doi.org/10.1016/S1386-4181(01)00024-6

- Amihud, Y., Hameed, A., Kang, W., and Zhang, H. (2015). The Illiquidity Premium: International Evidence. Journal of Financial Economics 117(2), 350–368. https://doi.org/10.1016/j.jfineco.2015.04.005

- Cervelló-Royo, R., and Guijarro, F. (2020). Forecasting stock market trend: a comparison of machine learning algorithms. Finance, Markets and Valuation 6(1), 37-49. https://doi.org/10.46503/NLUF8557

- Chen, H., De, P., Hu, Y., and Hwang, B. H. (2011). Sentiment revealed in social media and its effect on the stock market. IEEE Statistical Signal Processing Workshop (SSP), 25–28. https://doi.org/10.1109/SSP.2011.5967675

- Corwin, S. A., and Schultz, P. (2012). A Simple Way to Estimate Bid-Ask Spreads from Daily High and Low Prices. The Journal of Finance 67(2), 719-760. https://doi.org/10.1111/j.1540-6261.2012.01729.x

- Gorton, G., and Metrick, A. (2010). Haircuts. Federal Reserve Bank St Louis Review 92(6), 507–520. https://doi.org/10.20955/r.92.507-20

- Goyenko, R. Y., Holden, C. W., and Trzcinka, C. A. (2009). Do liquidity measures measure liquidity? Journal of Financial Economics 92(2), 153–181. https://doi.org/10.1016/j.jfineco.2008.06.002

- Guijarro, F., Moya-Clemente, I., and Saleemi, J. (2019). Liquidity Risk and Investors’ Mood: Linking the Financial Market Liquidity to Sentiment Analysis through Twitter in the S&P500 Index. Sustainability 11, 7048. https://doi.org/10.3390/su11247048

- Guijarro, F., Moya-Clemente, I., and Saleemi, J. (2021). Market Liquidity and Its Dimensions: Linking the Liquidity Dimensions to Sentiment Analysis through Microblogging Data. Journal of Risk and Financial Management 14(9), 394. https://doi.org/10.3390/jrfm14090394

- Li, Q., Chen, Y., Wang, J., Chen, Y., and Chen, H. (2018). Web media and stock markets: A survey and future directions from a big data perspective. IEEE Transactions on Knowledge and Data Engineering 30(2), 381–399. https://doi.org/10.1109/TKDE.2017.2763144

- Mazboudi, M., and Khalil, S. (2017). The attenuation effect of social media: Evidence from acquisitions by large firms. Journal of Financial Stability 28(C), 115-124. https://doi.org/10.1016/j.jfs.2016.11.010

- Nofsinger, J. R. (2005). Social Mood and Financial Economics. Journal of Behavioral Finance 6(3), 144-160. https://doi.org/10.1207/s15427579jpfm0603_4

- Prokofieva, M. (2015). Twitter-based dissemination of corporate disclosure and the intervening effects of firms’ visibility: Evidence from Australian-listed companies. Journal of Information Systems 29(2), 107-136. https://doi.org/10.2308/isys-50994

- Saleemi, J. (2022). Asymmetric information modelling in the realized spread: A new simple estimation of the informed realized spread. Finance, Markets and Valuation 8(1), 1–12. https://doi.org/10.46503/JQYH3943