COVID-19 and SMEs deposits with commercial banks: evidence from African economies

Abstract

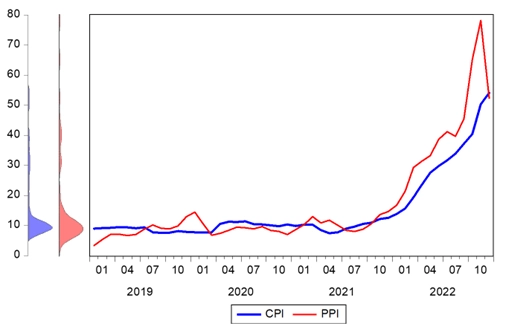

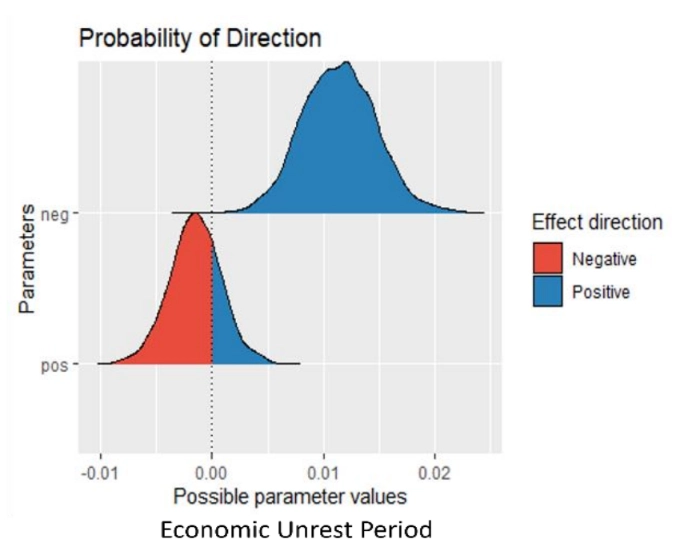

This paper examines the impact of COVID-19 on Small and medium-sized enterprises (SMEs) deposits across 13 African nations from 2016 to 2022, using a seven-year dataset and Ordinary Least Squares estimator. Notably, it uncovers a significant positive link between the pandemic and SMEs deposits, indicating heightened reserves amidst economic uncertainty, potentially driven by risk mitigation or government support. Associations between gross domestic product (GDP), inflation, unemployment, foreign direct investment (FDI), exchange rates, and SMEs deposits were evident, showcasing higher GDP aligning with increased deposits, while inflation and unemployment linked to reduced ones. FDI showed a positive influence, and exchange rate fluctuations notably affected SMEs deposits, especially for those in international trade. These findings emphasize policy reconsideration for crisis strategies supporting SMEs reserves during uncertainty and interventions addressing inflation, unemployment, and exchange rate risks. Future research exploring regional nuances and global comparisons could further enrich policymaking for resilient SMEs amid evolving economic landscapes.

Cite This Paper

Saif-Alyousfi, A. Y. (2024). COVID-19 and SMEs deposits with commercial banks: evidence from African economies. Financial Economics Letters, 3(1), 19. doi:10.58567/fel03010006

Saif-Alyousfi, A. Y. COVID-19 and SMEs deposits with commercial banks: evidence from African economies. Financial Economics Letters, 2024, 3, 19. doi:10.58567/fel03010006

Saif-Alyousfi A Y. COVID-19 and SMEs deposits with commercial banks: evidence from African economies. Financial Economics Letters; 2024, 3(1):19. doi:10.58567/fel03010006

Saif-Alyousfi, Abdulazeez Y. 2024. "COVID-19 and SMEs deposits with commercial banks: evidence from African economies" Financial Economics Letters 3, no.1:19. doi:10.58567/fel03010006

Share and Cite

Article Metrics

References

- Alharbi, R. K. (2023). Saudi Arabia’s small and medium enterprises (SMES) sector post-Covid-19 recovery: stakeholders’ perception on investment sustainability. International Journal of Organizational Analysis, 31(6), 2222-2238. https://doi.org/10.1108/IJOA-10-2021-2993

- Ashiru, F., Adegbite, E., Nakpodia, F., & Koporcic, N. (2022). Relational governance mechanisms as enablers of dynamic capabilities in Nigerian SMEs during the COVID-19 crisis. Industrial Marketing Management, 105, 18-32. https://doi.org/10.1016/j.indmarman.2022.05.011

- Chen, J., Cheng, Z., Gong, R. K., & Li, J. (2022). Riding out the covid-19 storm: How government policies affect smes in china. China Economic Review, 75, 101831. https://doi.org/10.1016/j.chieco.2022.101831

- Crick, F., Eskander, S. M., Fankhauser, S., & Diop, M. (2018). How do African SMEs respond to climate risks? Evidence from Kenya and Senegal. World Development, 108, 157-168.

- Dai, R., Feng, H., Hu, J., Jin, Q., Li, H., Wang, R., ... & Zhang, X. (2021). The impact of COVID-19 on small and medium-sized enterprises (SMEs): Evidence from two-wave phone surveys in China. China Economic Review, 67, 101607. https://doi.org/10.1016/j.chieco.2021.101607

- Díez, F. J., Duval, R., & Maggi, C. (2022). Supporting SMEs during COVID-19: The case for targeted equity injections. Economics Letters, 219, 110717. https://doi.org/10.1016/j.econlet.2022.110717

- Doruk, Ö. T. (2023). Does Islamic banking reduce the risks of COVID-19 for SMEs? Novel evidence for SME financing in the pandemic period for an emerging market. International Journal of Disaster Risk Reduction, 91, 103664. https://doi.org/10.1016/j.ijdrr.2023.103664

- Du, L., Razzaq, A., & Waqas, M. (2023). The impact of COVID-19 on small-and medium-sized enterprises (SMEs): empirical evidence for green economic implications. Environmental Science and Pollution Research, 30(1), 1540-1561. https://doi.org/10.1007/s11356-022-22221-7

- Faeni, D. P., Puspitaningtyas Faeni, R., Alden Riyadh, H., & Yuliansyah, Y. (2023). The COVID-19 pandemic impact on the global tourism industry SMEs: a human capital development perspective. Review of International Business and Strategy, 33(2), 317-327. https://doi.org/10.1108/RIBS-08-2021-0116

- Fang J, Collins A, Yao S (2021) On the global COVID‑19 pandemic and China’s FDI. J Asian Econ 74:101300

- Giofré M (2021) COVID‑19 stringency measures and foreign investment: an early assessment. North Am J Econ Finance 58:101536. https://doi. org/10. 1016/j. najef. 2021. 101536

- Gur, N., Babacan, M., Aysan, A. F., & Suleyman, S. (2023). Firm Size and Financing Behavior during COVID-19 Pandemic: Evidence from SMEs in Istanbul. Borsa Istanbul Review.

- Ho LT, Gan C (2021) Foreign direct investment and world pandemic uncertainty index: do health pandemics matter? J Risk Financ Manag 14(107):1–15. https://doi.org/10. 3390/ jrfm1 40301 07

- Hossain, M. R., Akhter, F., & Sultana, M. M. (2022). SMEs in covid-19 crisis and combating strategies: a systematic literature review (SLR) and A case from emerging economy. Operations research perspectives, 9, 100222. https://doi.org/10.1016/j.orp.2022.100222

- Jalil, M. F., Tariq, B., Zaheer, M. A., & Ahmed, Z. (2023). Responses to COVID-19, small and medium enterprises’ corporate social responsibility and psychological capital of employees: From the mediating perspective of affective commitment. Heliyon, 9(4).

- Kotcharin, S., Maneenop, S., & Jaroenjitrkam, A. (2023). The impact of government policy responses on airline stock return during the COVID-19 crisis. Research in Transportation Economics, 99, 101298. https://doi.org/10.1016/j.retrec.2023.101298

- Mena, C., Karatzas, A., & Hansen, C. (2022). International trade resilience and the Covid-19 pandemic. Journal of Business Research, 138, 77-91. https://doi.org/10.1016/j.jbusres.2021.08.064

- Mohsin, M., Nurunnabi, M., Zhang, J., Sun, H., Iqbal, N., Iram, R., & Abbas, Q. (2020). The evaluation of efficiency and value addition of IFRS endorsement towards earnings timeliness disclosure. International Journal of Finance & Economics, 26(2), 1793-1807. https://doi.org/10.1002/ijfe.1878

- Mohsin, M., Taghizadeh-Hesary, F., & Shahbaz, M. (2022). Nexus between financial development and energy poverty in Latin America. Energy Policy, 165, 112925. https://doi.org/10.1016/j.enpol.2022.112925

- Mohsin, M., Ullah, H., Iqbal, N., Iqbal, W., & Taghizadeh-Hesary, F. (2021). How external debt led to economic growth in South Asia: A policy perspective analysis from quantile regression. Economic Analysis and Policy, 72, 423-437. https://doi.org/10.1016/j.eap.2021.09.012

- Nitsch, V. (2022). Covid-19 and international trade: Evidence from New Zealand. Economics Letters, 217, 110627. https://doi.org/10.1016/j.econlet.2022.110627

- Okuwhere, M. P., & Tafamel, A. E. (2022). Coronavirus (COVID-19) and Entrepreneurship in Africa: Challenges and Opportunities for Small and Medium Enterprises Innovation. Entrepreneurship and Post-Pandemic Future, 7-21. https://doi.org/10.1108/978-1-80117-902-720221002

- Quartey, P., Turkson, E., Abor, J. Y., & Iddrisu, A. M. (2017). Financing the growth of SMEs in Africa: What are the contraints to SME financing within ECOWAS?. Review of development finance, 7(1), 18-28. https://doi.org/10.1016/j.rdf.2017.03.001

- Rojas-García, J. A., Elias-Giordano, C., Quiroz-Flores, J. C., & Nallusamy, S. (2024). Profitability enhancement by digital transformation and canvas digital model on strategic processes in post-Covid-19 in logistics SMEs. Social Sciences & Humanities Open, 9, 100777. https://doi.org/10.1016/j.ssaho.2023.100777

- Rubio-Andrés, M., del Mar Ramos-González, M., Sastre-Castillo, M. Á., & Gutiérrez-Broncano, S. (2023). Stakeholder pressure and innovation capacity of SMEs in the COVID-19 pandemic: Mediating and multigroup analysis. Technological Forecasting and Social Change, 190, 122432. https://doi.org/10.1016/j.techfore.2023.122432

- Saif-Alyousfi, A. Y. (2021). FDI inflows and bank deposits: evidence from 18 MENA economies. Competitiveness Review: An International Business Journal, 32(6), 880-914.

- Saif-Alyousfi, A. Y. (2022). Determinants of bank profitability: evidence from 47 Asian countries. Journal of Economic Studies, 49(1), 44-60. https://doi.org/10.1108/jes-05-2020-0215

- Saif-Alyousfi, A. Y. (2022). The impact of COVID-19 and the stringency of government policy responses on stock market returns worldwide. Journal of Chinese Economic and Foreign Trade Studies, 15(1), 87-105.

- Saif-Alyousfi, A. Y. (2023). Impact of FDI inflows on bank loans in Gulf Cooperation Council economies: an empirical insight. International Journal of Emerging Markets, 18(2), 505-524. https://doi.org/10.1108/ijoem-06-2019-0465

- Saif-Alyousfi, A. Y., & Saha, A. (2021). Do tourism receipts affect bank profitability? Analytical evidence from 85 tourism economies. Research in International Business and Finance, 58, 101437. https://doi.org/10.1016/j.ribaf.2021.101437

- Saif-Alyousfi, A. Y., & Saha, A. (2021b). Determinants of banks’ risk-taking behavior, stability and profitability: Evidence from GCC countries. International Journal of Islamic and Middle Eastern Finance and Management, 14(5), 874-907.

- Saif-Alyousfi, A. Y., & Saha, A. (2021c). The impact of COVID-19 and non-pharmaceutical interventions on energy returns worldwide. Sustainable Cities and Society, 70, 102943. https://doi.org/10.1108/imefm-03-2019-0129

- Saif-Alyousfi, A. Y., Saha, A., & Alshammari, T. R. (2023). Bank diversification and ESG activities: A global perspective. Economic Systems, 101094. https://doi.org/10.1016/j.ecosys.2023.101094

- Saif-Alyousfi, A. Y., Saha, A., & Md-Rus, R. (2020). The impact of bank competition and concentration on bank risk-taking behavior and stability: Evidence from GCC countries. The North American Journal of Economics and Finance, 51, 100867. https://doi.org/10.1016/j.najef.2018.10.015

- Saif-Alyousfi, A. Y., Saha, A., Md-Rus, R., & Taufil-Mohd, K. N. (2021a). Do oil and gas price shocks have an impact on bank performance?. Journal of Commodity Markets, 22, 100147. https://doi.org/10.1016/j.jcomm.2020.100147

- Santolin, R. B., Hameed, H. B., Urbinati, A., & Lazzarotti, V. (2023). Exploiting circular economy enablers for SMEs to advance towards a more sustainable development: An empirical study in the post COVID-19 era. Resources, Conservation & Recycling Advances, 19, 200164. https://doi.org/10.1016/j.rcradv.2023.200164

- Simo Kengne, B. D. (2016). Mixed-gender ownership and financial performance of SMEs in South Africa: A multidisciplinary analysis. International Journal of Gender and Entrepreneurship, 8(2), 117-136.

- Thekkoote, R. (2023). Factors influencing small and medium-sized enterprise (SME) resilience during the COVID-19 outbreak. The TQM Journal.

- Venkatachalam, S., Marshall, A., Ojiako, U., & Chanshi, C. S. (2020). Organisational learning in small and medium sized South African energy project organisations. Management Research Review, 43(5), 595-623. https://doi.org/10.1108/MRR-02-2019-0068

- Wang, Z., & Le, T. T. (2022). The COVID-19 pandemic’s effects on SMEs and travel agencies: The critical role of corporate social responsibility. Economic Analysis and Policy, 76, 46-58. https://doi.org/10.1016/j.eap.2022.07.008

- Wellalage, N. H., Kumar, V., Hunjra, A. I., & Al-Faryan, M. A. S. (2022). Environmental performance and firm financing during COVID-19 outbreaks: Evidence from SMEs. Finance Research Letters, 47, 102568. https://doi.org/10.1016/j.frl.2021.102568

- Xiuzhen, X., Zheng, W., & Umair, M. (2022). Testing the fluctuations of oil resource price volatility: a hurdle for economic recovery. Resources Policy, 79, 102982. https://doi.org/10.1016/j.resourpol.2022.102982

- Yao, Z., & Liu, Y. (2023). How Covid-19 impacts the financing in SMEs: Evidence from private firms. Economic Analysis and Policy. https://doi.org/10.1016/j.eap.2023.06.036

- Zahoor, N., Khan, Z., Meyer, M., & Laker, B. (2023). International entrepreneurial behavior of internationalizing African SMEs–Towards a new research agenda. Journal of Business Research, 154, 113367. https://doi.org/10.1016/j.jbusres.2022.113367

- Zhang, X., Liu, H., & Yao, P. (2021). Research jungle on online consumer behaviour in the context of web 2.0: traceability, frontiers and perspectives in the post-pandemic era. Journal of Theoretical and Applied Electronic Commerce Research, 16(5), 1740-1767. https://doi.org/10.3390/jtaer16050098

- Zhao, J., Cao, J., & Huang, J. (2023). CEO/board medical background and stock returns during the COVID-19 pandemic. Economic Modelling, 127, 106469. https://doi.org/10.1016/j.econmod.2023.106469

- Zheng, X., Zhou, Y., & Iqbal, S. (2022). Working capital management of SMEs in COVID-19: role of managerial personality traits and overconfidence behavior. Economic Analysis and Policy, 76, 439-451. https://doi.org/10.1016/j.econmod.2023.106469