Macroeconomic Drivers of Electricity Prices in Nigeria

Abstract

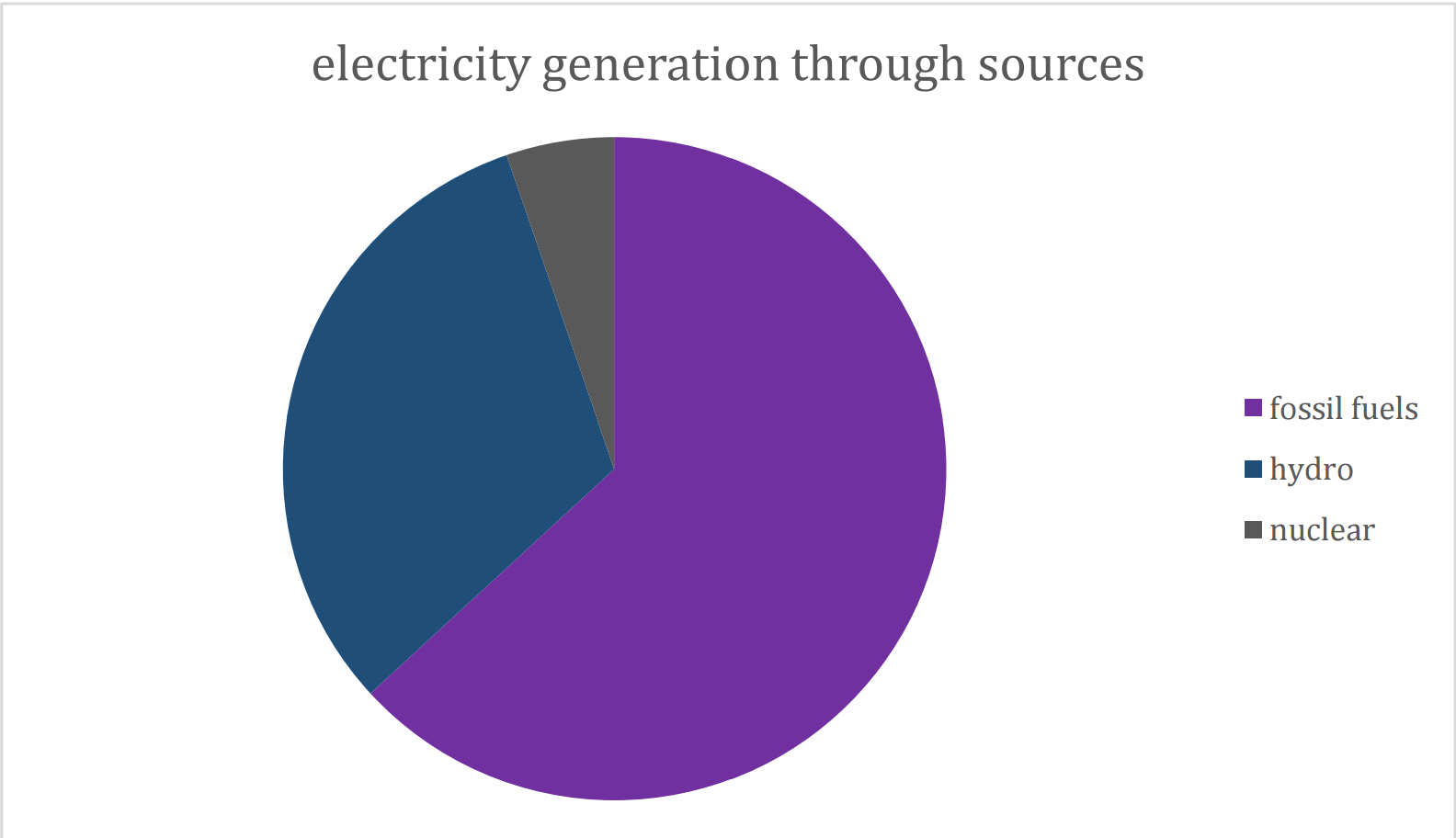

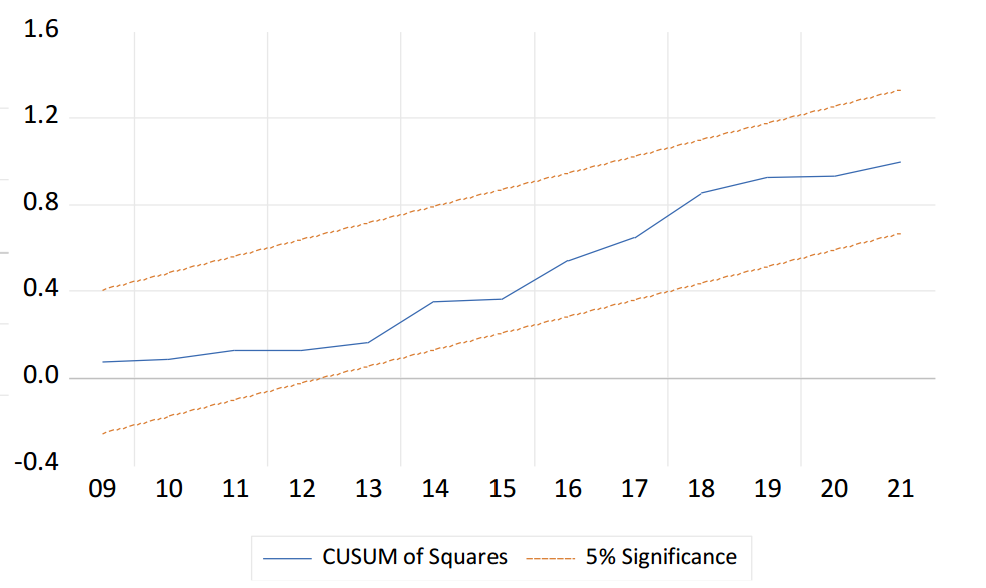

Electricity price volatility in developing economies, particularly Nigeria, presents a significant challenge to sustainable development. In this paper, we examine the macroeconomic drivers of electricity prices (ELP) in Nigeria based on annual data spanning 1980-2022 and the autoregressive distributed lag (ARDL) procedure. Our model estimates the long-run and short-run impacts of population growth (PG), economic growth (GDP), crude oil price (COPR), and electricity consumption (ELC) on electricity prices (ELP). The empirical findings reveal a positive and long-run effect of PG on ELP, indicating that rising demand from a growing population increases electricity prices. In the short-run, ELC surprisingly co-moved with ELP, which may be attributable to price-sensitive demand within specific consumer segments or periods. Furthermore, GDP and COPR exert positive effects on ELP, indicating that economic growth drives energy consumption and prices, and the cost-driven impact of fossil fuel dependence in electricity generation. These findings shed light on the complex interplay of demographic, economic, and energy market-related forces driving electricity prices in Nigeria. Therefore, the paper proposes some policy suggestions based on the empirical findings.

Cite This Paper

Bala, M., Ahmad Moyi, N., & Gummi, U. M. (2024). Macroeconomic Drivers of Electricity Prices in Nigeria. Energy Technologies and Environment, 2(3), 17. doi:10.58567/ete02030002

Bala, M.; Ahmad Moyi, N.; Gummi, U. M. Macroeconomic Drivers of Electricity Prices in Nigeria. Energy Technologies and Environment, 2024, 2, 17. doi:10.58567/ete02030002

Bala M, Ahmad Moyi N, Gummi U M. Macroeconomic Drivers of Electricity Prices in Nigeria. Energy Technologies and Environment; 2024, 2(3):17. doi:10.58567/ete02030002

Bala, Mansur; Ahmad Moyi, Nasir; Gummi, Umar M. 2024. "Macroeconomic Drivers of Electricity Prices in Nigeria" Energy Technologies and Environment 2, no.3:17. doi:10.58567/ete02030002

Share and Cite

Article Metrics

References

- Adeniran, A. O., & Igbatayo, S. (2016). The impact of petroleum price volatility on Nigeria's economy. Institute for Oil, Gas, Energy, Environment and Sustainable Development. https://scholar.google.com/scholar?cluster=14697771314491833691&hl=en&oi=scholarr

- Blanca, M., Ana J, L., & María Teresa, G.-Á. (2012). The electricity prices in the European Union: The role of renewable energies and regulatory electric market reforms. Energy, 48(1), 307-313. http://dx.doi.org/10.1016/j.energy.2012.06.059

- Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115-143. https://doi.org/10.1016/S0304-4076(98)00009-8

- Brown, R., Durbin, J., & Evans, K. (1975). Techniques for testing the constancy of regression relationships over time. Journal of the Royal Statistical Society. Series B (Methodological), 149-192. http://www.jstor.org/stable/2984889?origin=JSTOR-pdf

- Caroline, B. (2022, July 30). Theory of price. Investopedia. Retrieved February 10, 2022, from https://www.investopedia.com/terms/t/theory-of-price.asp

- Doris, D. S. (2023). Share of population with access to electricity in Nigeria 2011-2021. Statista. https://www.statista.com/statistics/1307416/total-population-access-to-electricity-in-nigeria

- Energy Information Administration. (2022, April 20). U.S. Energy Information Administration. Retrieved from https://www.eia.gov/

- Engle, R., & Patton, A. (2007). What good is a volatility model? Quantitative Finance, 1(2), 237-245. https://doi.org/10.1016/B978-075066942-9.50004-2

- Erkan, E. (2011). The impact of power market reforms on electricity price-cost margins and cross-subsidy levels: Across country panel data analysis. Energy Policy, 39(12), 1080-1092. http://dx.doi.org/10.1016/j.enpol.2010.11.023

- Eydeland, A., & Wolyniec, K. (2003). Energy and power risk management: New developments in modeling, pricing, and hedging. (2nd ed.). John Wiley & Sons. https://www.wiley.com/en-ie/search?filters[author]=Alexander%20Eydeland&pq=++

- Girish, P. G., & Vijayalakshmi, G. (2013). Determinants of electricity price in the competitive power market. International Journal of Business and Management, 8(21), 70-75. http://dx.doi.org/10.5539/ijbm.v8n21p70

- Goutam, D., & Krishnendranath, M. (2017). A literature review on dynamic pricing of electricity. Journal of the Operational Research Society, 68(10), 1131-1145. https://ideas.repec.org/a/pal/jorsoc/v68y2017i10d10.1057_s41274-016-0149-4.html

- Hadsell, L., Marathe, A., & Shawky, H. A. (2004). Estimating the volatility of wholesale electricity spot prices in the US. The Energy Journal, 25(4), 23-40. https://ideas.repec.org/a/aen/journl/2004v25-04-a02.html

- Harris, C. (2006). Electricity markets: Pricing, structures and economics. John Wiley & Sons. https://www.perlego.com/book/1009703/electricity-markets-pricing-structures-and-economics-pdf

- Karakatsani, N. V., & Bunn, D. W. (2004). Modeling the volatility of spot electricity prices. International Journal of Forecasting, 24(5), 764-785. https://api.semanticscholar.org/CorpusID:27454378

- Kirschen, D., & Strbac, G. (2004). Fundamentals of power system economics. John Wiley & Sons. http://dx.doi.org/10.1002/0470020598

- Knittel, C. R., & Roberts, M. R. (2015). An empirical examination of restructured electricity prices. Energy Economics, 27(5), 791-817. Retrieved from https://ideas.repec.org/s/eee/eneeco.html

- Li, K., Cursio, J. D., Sun, Y., & Zhu, Z. (2019). Determinants of price fluctuations in the electricity market: a study with PCA and NARDL models. Economic Research-Ekonomska Istraživanja, 32(1), 2404–2421. https://doi.org/10.1080/1331677X.2019.1645712

- Longstaff, F. A., & Wang, A. W. (2004). Electricity forward prices: A high-frequency empirical analysis. Journal of Finance, 59(4), 1877-1900. http://dx.doi.org/10.1111/j.1540-6261.2004.00682.x

- Mahadeva, L., & Robinson, P. (2004). Unit root testing to help model building. Handbooks in Central Banking No. 22 Centre for Central Banking Studies, Bank of England, London. Retrieved from http://www.bankofengland.co.uk/education/Pages/ccbs/handbooks/ccbshb22.aspx

- Nagayama, H. (2007). Effects of regulatory reforms in the electricity supply industry on electricity prices in developing countries. Energy Policy, 3440-3462. http://dx.doi.org/10.1016/j.enpol.2006.12.018

- Nigerian Electricity Regulatory Commission (NERC). (2021, November 12). Electricity meter prices go up. PM NEWS Nigeria. Retrieved from https://pmnewsnigeria.com/2021/11/12/electricity-meter-prices-go-up/

- Oiol, P. (2019, May 20). Solar energy. Retrieved December 2022, from Solar-energy. technology: www.ectronicalfunderblog.com

- Ologbenla, P. (2021). Determinants of domestic energy prices in Nigeria (1980-2020). Obafemi Awolowo University, Ile Ife, Osun State, Nigeria, 3(2), 305-311. https://doi.org/10.25082/REE.2021.02.006

- Ologundudu, M. M., & Abioro, M. A. (2018). Petroleum pump price increase and business environment: The Nigerian Economy Standpoint. IOSR Journal of Business and Management (IOSR-JBM), 20(3), 60-70. http://dx.doi.org/10.9790/487X-2003046070

- Patrícia, S. P., & Cerqueira, P. A. (2017). Assessing the determinants of household electricity prices in the EU: A system-GMM panel data approach. Renewable and Sustainable Energy Reviews, 1131-1137. https://ideas.repec.org/a/eee/rensus/v73y2017icp1131-1137.html

- Pesaran, M. H., Smith, R. J., & Shin, Y. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289-326. https://doi:10.1002/jae.616

- Ralf, B., Stan, H., & Vlad, P. (2007). Modeling spikes in electricity prices. The Economic Record, 83(263), 371-382. http://dx.doi.org/10.1111/j.1475-4932.2007.00427.x

- Ricardo, D. (1817). On the principles of political economy and taxation. London: John Murray. https://www.scirp.org/reference/referencespapers?referenceid=1986007

- Smith, A. (1776). An inquiry into the nature and causes of the wealth of nations. Clarendon Press, the Glasgow Edition of the Works and Correspondence of Adam Smith. ttps://www.econlib.org/library/Smith/smWN.html

- Sonal, G., Deepankar, C., & Hiranmoy, R. (2020). Electricity prices determinants: India's perspective. International Journal Business Excellence, 549-560. http://dx.doi.org/10.1504/IJBEX.2019.10019286

- Sorokin, S. Rebennack, P. M. Pardalos, N. A. Iliadis, & M. V. F. Pereira (Eds.), Handbook of Networks in Power Systems I (pp. 89-121). Springer. http://dx.doi.org/10.1007/978-3-642-02493-1

- Steiner, F. (2001). Regulation, industry structure and performance in the electricity supply industry, OECD Economics Studies. OECD. http://dx.doi.org/10.2139/ssrn.223648

- Stephanía, M.-L., & Anjali, N. (2019). Drivers of electricity price dynamics: Comparative analysis of spot and futures markets. Energy, 76-87. http://dx.doi.org/10.1016/j.enpol.2018.11.020

- Sule, A. G. (2005). Short note on the history of capitalist and socialist economic thought (2nd ed.). October.

- Umar, H. A., Mathias, F., & Praisad, R. (2022). Towards sustainability of power utilities in Nigeria: A Bayesian network approach. International Journal of Information Technology, 14(2), 14-27. http://dx.doi.org/10.1007/s41870-022-00876-2

- Weron, R. (2006). Modeling and forecasting electricity loads and prices: A statistical approach. John Wiley & Sons. https://doi.org/10.1002/9781118673362

- Weron, R., & Misiorek, A. (2008). Forecasting spot electricity prices: A comparison of parametric and semi-parametric time series models. International Journal of Forecasting, 24(5), 744-76. http://dx.doi.org/10.1016/j.ijforecast.2008.08.004

- Windermeijer, F. (2005). A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics, 126, 25-51. https://doi.org/10.1016/j.jeconom.2004.02.005

- Xiao, Y., Colwell, D. B., & Bhar, R. (2015). Risk premium in electricity prices: Evidence from the PJM market. Journal of Futures Markets, 35(8), 776-793. https://doi.org/10.1002/fut.21681

- Zareipour, H., (2012). Short-term electricity market prices: a review of characteristics and forecasting methods. In: Sorokin, A., Rebennack, S., Pardalos, P.M., Iliadis, N.A., Pereira, M.V.F. (Eds.), Handbook of Networks in Power Systems I. Springer, pp. 89–121. http://dx.doi.org/10.1007/978-3-642-23193-3_4

- Zareipour, H., Bhattacharya, K., & Cañizares, C. A. (2007). Electricity market price volatility: The case of Ontario. Energy Policy, 35(9), 4739-4748. https://doi.org/10.1016/j.enpol.2007.04.006