Green transportation taxes and environmental sustainability: China experience

Abstract

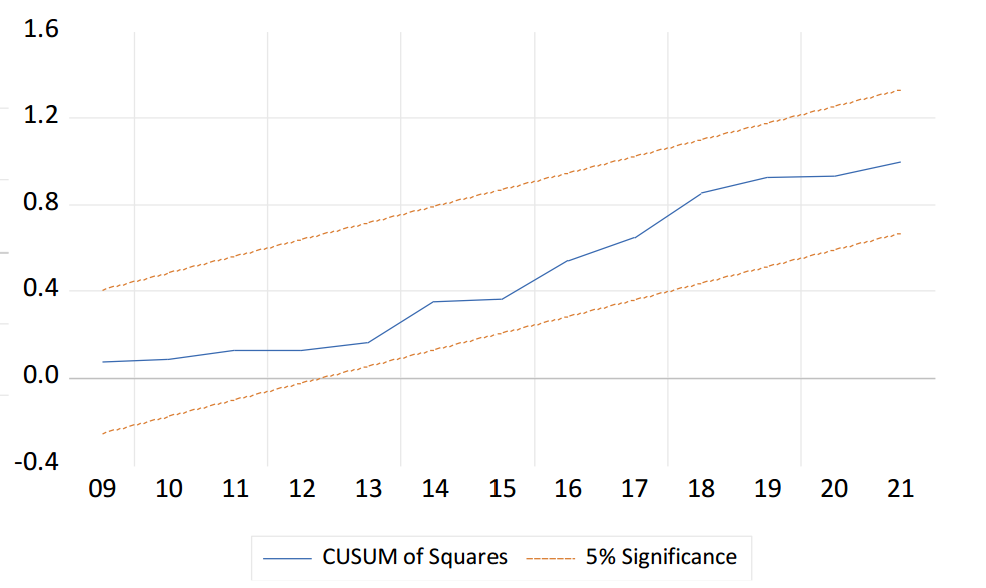

Environmental degradation is becoming a fundamental issue as it is directly associated with human lives and environmental sustainability. This research particularly highlights the significance of green transportation taxes in achieving environmental sustainability due to limited available literature considering the environmental sustainability and green transportation taxes nexus. By employing the newly developed QARDL approach, this study is unfolding the linkages of green transportation taxes on transport-based CO2 emissions for Chinese economy spanning 1992 to 2020. The results infer that green transportation taxes to enhance environmental sustainability in the long-run for the highest quantiles, i.e., 0.70 to 0.95. Though, green transportation taxes enhance environmental sustainability in all quantiles in the short-run. Based on these results, the study suggests that the Chinese government and policymakers should increase green transportation taxes that help in combating CO2 emissions, which ultimately enhances environmental sustainability.

Cite This Paper

NUREEN, N., Ali, M. S. e., & Sharjeel, M. (2024). Green transportation taxes and environmental sustainability: China experience. Energy Technologies and Environment, 2(2), 15. doi:10.58567/ete02020005

NUREEN, N.; Ali, M. S. e.; Sharjeel, M. Green transportation taxes and environmental sustainability: China experience. Energy Technologies and Environment, 2024, 2, 15. doi:10.58567/ete02020005

NUREEN N, Ali M S e, Sharjeel M. Green transportation taxes and environmental sustainability: China experience. Energy Technologies and Environment; 2024, 2(2):15. doi:10.58567/ete02020005

NUREEN, NAILA; Ali, Muhammad S. e.; Sharjeel, Muhammad 2024. "Green transportation taxes and environmental sustainability: China experience" Energy Technologies and Environment 2, no.2:15. doi:10.58567/ete02020005

Share and Cite

Article Metrics

References

- Aydin, C., & Esen, Ö. (2018). Reducing CO2 emissions in the EU member states: Do environmental taxes work? Journal of Environmental Planning and Management, 61(13), 2396–2420. https://doi.org/10.1080/09640568.2017.1395731

- Adebayo TS, Alola AA (2023) Drivers of natural gas and renewable energy utilization in the USA: How about household energy efficiency-energy expenditure and retail electricity prices? Energy 283. https://doi.org/10.1016/j.energy.2023.129022

- Adebayo TS, Kirikkaleli D (2021) Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: application of wavelet tools. Environmental Development Sustainability 23:16057–16082. https://doi.org/10.1007/s10668-021-01322-2

- Adebayo TS, Özkan O (2024) Investigating the influence of socioeconomic conditions, renewable energy and eco-innovation on environmental degradation in the United States: A wavelet quantile-based analysis. Journal of Cleaner Production 434. https://doi.org/10.1016/j.jclepro.2023.140321

- Akram R, Ibrahim RL, Wang Z, et al (2023) Neutralizing the surging emissions amidst natural resource dependence, eco-innovation, and green energy in G7 countries: Insights for global environmental sustainability. Environment Management 344. https://doi.org/10.1016/j.jenvman.2023.118560

- Beckerman, W. (1992). Economic growth and the environment: Whose growth? Whose environment? World Development, 20(4), 481–496. https://doi.org/10.1016/0305-750X(92)90038-W

- Cho, J. S., Kim, T., & Shin, Y. (2015). Quantile cointegration in the autoregressive distributed-lag modeling framework. Journal of Econometrics, 188(1), 281–300. https://doi.org/10.1016/j.jeconom.2015.05.003

- Doğan, B., Chu, L. K., Ghosh, S., Truong, H. H. D., & Balsalobre-Lorente, D. (2022). How environmental taxes and carbon emissions are related in the G7 economies? Renewable Energy, 187, 645–656. https://doi.org/10.1016/j.renene.2022.01.077

- Hao, L.-N., Umar, M., Khan, Z., & Ali, W. (2021). Green growth and low carbon emission in G7 countries: How critical the network of environmental taxes, renewable energy and human capital is? Science of The Total Environment, 752. https://doi.org/10.1016/j.scitotenv.2020.141853

- He P, Shang Y, Ajaz T, et al (2022) Assessment of Critical Factors Influencing Consumers’ Acceptance of Wearable Sports Devices During COVID-19 Pandemic Conditions. Frontiers in Energy Research 10:. https://doi.org/10.3389/fenrg.2022.877260

- Hussain, Z., Kaleem Khan, M., & Xia, Z. (2022). Investigating the role of green transport, environmental taxes and expenditures in mitigating the transport CO2 emissions. Transportation Letters, 1–11. https://doi.org/10.1080/19427867.2022.2065592

- Lin, B., & Li, X. (2011). The effect of carbon tax on per capita CO2 emissions. Energy Policy, 39(9), 5137–5146. https://doi.org/10.1016/j.enpol.2011.05.050

- Liu, Y., & Lu, Y. (2015). The economic impact of different carbon tax revenue recycling schemes in China: A model-based scenario analysis. Applied Energy, 141, 96–105. https://doi.org/10.1016/j.apenergy.2014.12.032

- Li B, Amin A, Nureen N, et al (2024) Assessing factors influencing renewable energy deployment and the role of natural resources in MENA countries. Resources Policy 88:. https://doi.org/10.1016/j.resourpol.2023.104417

- McKibbin, W. J., Morris, A. C., Wilcoxen, P. J., & Cai, Y. (2015). Carbon taxes and US fiscal reform. National Tax Journal, 68(1), 139–155. https://doi.org/10.17310/ntj.2015.1.06

- Nakata, T., & Lamont, A. (2001). Analysis of the impacts of carbon taxes on energy systems in Japan. Energy Policy, 29(2), 159–166. https://doi.org/10.1016/S0301-4215(00)00104-X

- Nong, D., Simshauser, P., & Nguyen, D. B. (2021). Greenhouse gas emissions vs CO2 emissions: Comparative analysis of a global carbon tax. Applied Energy, 298. https://doi.org/10.1016/j.apenergy.2021.117223

- Nguyen-Thi-Lan H, Fahad S, Nguyen-Anh T, et al (2021). Assessment of farm households’ perception, beliefs and attitude toward climatic risks: A case study of rural Vietnam. PLoS One 16. https://doi.org/10.1371/journal.pone.0258598

- Nureen N, Liu D, Irfan M, et al (2023a) Nexuses among Green Supply Chain Management, Green Human Capital, Managerial Environmental Knowledge, and Firm Performance: Evidence from a Developing Country. Sustainability. https://doi.org/10.3390/su15065597

- Nureen N, Liu D, Irfan M, Sroufe R (2023b) Greening the manufacturing firms: do green supply chain management and organizational citizenship behavior influence firm performance? Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-023-27817-1

- Nureen N, Xin Y, Irfan M, Fahad S (2023c) Going green: how do green supply chain management and green training influence firm performance? Evidence from a developing country. Environmental Science and Pollution Research. http://dx.doi.org/10.1007/s11356-023-26609-x

- Potter, S., & Parkhurst, G. (2005). Transport policy and transport tax reform. Public Money and Management, 25(3), 171–178. https://doi.org/10.1111/j.1467-9302.2005.00470.x

- Rausch, S., & Reilly, J. (2012). Carbon tax revenue and the budget deficit: A win-win-win solution? MIT Joint Program on the Science and Policy of Global Change.

- Safi, A., Chen, Y., Wahab, S., Zheng, L., & Rjoub, H. (2021). Does environmental taxes achieve the carbon neutrality target of G7 economies? Evaluating the importance of environmental R&D. Journal of Environmental Management, 293. https://doi.org/10.1016/j.jenvman.2021.112908

- Shah, K. J., Pan, S.-Y., Lee, I., Kim, H., You, Z., Zheng, J.-M., & Chiang, P.-C. (2021). Green transportation for sustainability: Review of current barriers, strategies, and innovative technologies. Journal of Cleaner Production, 326. https://doi.org/10.1016/j.jclepro.2021.129392

- Song J, Geng L, Fahad S (2022) Agricultural factor endowment differences and relative poverty nexus: an analysis of macroeconomic and social determinants. Environmental Science and Pollution Research, https://doi.org/10.1007/s11356-022-19474-7

- SU Fang, Liu Yu, Chen Jian Shao, Fahad Shah (2023) Towards the impact of economic policy uncertainty on food security: Introducing a comprehensive heterogeneous framework for assessment. Journal of Cleaner Production, 386. https://doi.org/10.1016/j.jclepro.2022.135792

- Shahzad, U. (2020). Environmental taxes, energy consumption, and environmental quality: Theoretical survey with policy implications. Environmental Science and Pollution Research, 27(20), 24848–24862. https://doi.org/10.1007/s11356-020-08349-4

- Solaymani, S. (2019). CO2 emissions patterns in 7 top carbon emitter economies: The case of transport sector. Energy, 168, 989–1001. https://doi.org/10.1016/j.energy.2018.11.145

- Tian, X., Dai, H., Geng, Y., Huang, Z., Masui, T., & Fujita, T. (2017). The effects of carbon reduction on sectoral competitiveness in China: A case of Shanghai. Applied Energy, 197, 270–278. https://doi.org/10.1016/j.apenergy.2017.04.026

- Tong, J., Yue, T., & Xue, J. (2022). Carbon taxes and a guidance-oriented green finance approach in China: Path to carbon peak. Journal of Cleaner Production, 367. https://doi.org/10.1016/j.jclepro.2022.133050

- Usman, A., Ozturk, I., Ullah, S., & Hassan, A. (2021). Does ICT have symmetric or asymmetric effects on CO2 emissions? Evidence from selected Asian economies. Technology in Society, 67. https://doi.org/10.1016/j.techsoc.2021.101692

- Wang, C., Wood, J., Wang, Y., Geng, X., & Long, X. (2020). CO2 emission in transportation sector across 51 countries along the Belt and Road from 2000 to 2014. Journal of Cleaner Production, 266. https://doi.org/10.1016/j.jclepro.2020.122000

- Wang K, Rehman MA, Fahad S, Linzhao Z (2023). Unleashing the influence of natural resources, sustainable energy and human capital on consumption-based carbon emissions in G-7 Countries. Resources Policy 81:. https://doi.org/10.1016/j.resourpol.2023.103384

- Xu C, Wang Q, Fahad S, et al (2022). Impact of Off-Farm Employment on Farmland Transfer: Insight on the Mediating Role of Agricultural Production Service Outsourcing. Agric 12:. https://doi.org/10.3390/agriculture12101617

- Yan, X., & Crookes, R. J. (2009). Reduction potentials of energy demand and GHG emissions in China’s road transport sector. Energy Policy, 37(2), 658–668. https://doi.org/10.1016/j.enpol.2008.10.008

- Yin, X., Chen, W., Eom, J., Clarke, L. E., Kim, S. H., Patel, P. L., Yu, S., & Kyle, G. P. (2015). China’s transportation energy consumption and CO2 emissions from a global perspective. Energy Policy, 82, 233–248. https://doi.org/10.1016/j.enpol.2015.03.021

- Yuelan, P., Akbar, M. W., Hafeez, M., Ahmad, M., Zia, Z., & Ullah, S. (2019). The nexus of fiscal policy instruments and environmental degradation in China. Environmental Science and Pollution Research, 26(28), 28919–28932. https://doi.org/10.1007/s11356-019-06071-4

- Zhu, L., He, L., Shang, P., Zhang, Y., & Ma, X. (2018). Influencing factors and scenario forecasts of carbon emissions of the Chinese power industry: Based on a Generalized Divisia Index Model and Monte Carlo Simulation. Energies, 11(9), 2398. https://doi.org/10.3390/en11092398