The Impact of Carbon Emissions Trading on the High Quality Development of Manufacturing Industry - The Evidence from China

Abstract

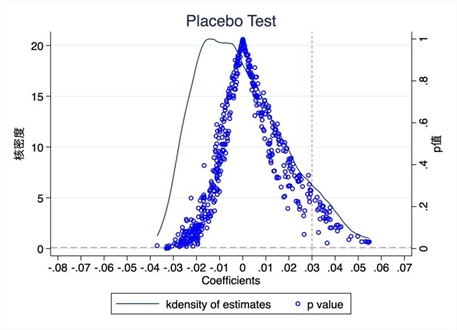

Carbon emissions trading is an important part of emission reduction policy tools, and manufacturing is the foundation of a strong country. This paper explores the impact of carbon emissions trading pilot on the high-quality development of manufacturing industry by using the double difference method. It is found that carbon emissions trading can significantly promote the high-quality development of manufacturing industry, in which the government's will of ecological environment governance, technological progress and industrial structure rationalization have significant intermediary effects. Heterogeneity analysis reveals that the impact of carbon emissions trading on the high-quality development of the manufacturing industry is most significant in the western region. Accordingly, the study proposes suggestions on how to further improve China's carbon emissions trading market and realize the high-quality development of the manufacturing industry.

Cite This Paper

Li, Y., & Zhu, C. (2023). The Impact of Carbon Emissions Trading on the High Quality Development of Manufacturing Industry - The Evidence from China. Climate Economics and Finance, 1(1), 4. doi:10.58567/cef01010004

Li, Y.; Zhu, C. The Impact of Carbon Emissions Trading on the High Quality Development of Manufacturing Industry - The Evidence from China. Climate Economics and Finance, 2023, 1, 4. doi:10.58567/cef01010004

Li Y, Zhu C. The Impact of Carbon Emissions Trading on the High Quality Development of Manufacturing Industry - The Evidence from China. Climate Economics and Finance; 2023, 1(1):4. doi:10.58567/cef01010004

Li, Ying; Zhu, Changgeng 2023. "The Impact of Carbon Emissions Trading on the High Quality Development of Manufacturing Industry - The Evidence from China" Climate Economics and Finance 1, no.1:4. doi:10.58567/cef01010004

Show Figures

Share and Cite

Article Metrics

References

- Cheng, Z., Meng, X. (2023). Can carbon emissions trading improve corporate total factor productivity?. Technological Forecasting and Social Change 195, 0040-1625. https://doi.org/10.1016/j.techfore.2023.122791

- Dai, S., Qian, Y., He, W., Wang, C., and Shi, T. (2022). The spatial spillover effect of China's carbon emissions trading policy on industrial carbon intensity: Evidence from a spatial difference-in-difference method. Structural Change and Economic Dynamics 63, 0954-349X. https://doi.org/10.1016/j.strueco.2022.09.010

- Dechezleprêtre, A., Nachtigall, D., and Venmans, F. (2023). The joint impact of the European Union emissions trading system on carbon emissions and economic performance. Journal of Environmental Economics and Management 118, 0095-0696. https://doi.org/10.1016/j.jeem.2022.102758

- Deng, H., Zhang, W., and Liu, D. (2023). Does carbon emission trading system induce enterprises green innovation?. Journal of Asian Economics 86, 1049-0078. https://doi.org/10.1016/j.asieco.2023.101597

- Du, M., Wu, F., Ye, D., Zhao, Y., and Liao, L. (2023). Exploring the effects of energy quota trading policy on carbon emission efficiency. Quasi-experimental evidence from China. Energy Economics 124, 0140-9883. https://doi.org/10.1016/j.eneco.2023.106791

- Hong, Q., Cui, L., and Hong, P. (2022). The impact of carbon emissions trading on energy efficiency: Evidence from quasi-experiment in China's carbon emissions trading pilot. Energy Economics 110, 0140-9883. https://doi.org/10.1016/j.eneco.2022.106025

- Lin, B., Guan, C. (2023). Evaluation and determinants of total unified efficiency of China's manufacturing sector under the carbon neutrality target. Energy Economics 119, 0140-9883. https://doi.org/10.1016/j.eneco.2023.106539

- Lin, B., Wu, N. (2022). Will the China's carbon emissions market increase the risk-taking of its enterprises?. International Review of Economics & amp; Finance 77, 1059-0560. https://doi.org/10.1016/j.iref.2021.10.005

- Liu, J., Liu, X. (2023). Effects of carbon emission trading schemes on green technological innovation by industrial enterprises: Evidence from a quasi-natural experiment in China. Journal of Innovation & Knowledge 8, 2444-569X. https://doi.org/10.1016/j.jik.2023.100410

- Liu, M., Li, Y. (2022). Environmental regulation and green innovation: Evidence from China's carbon emissions trading policy. Finance Research Letters 48, 1544-6123. https://doi.org/10.1016/j.frl.2022.103051

- Lv, M., Bai, M. (2021). Evaluation of China's carbon emission trading policy from corporate innovation. Finance Research Letters 39, 1544- 6123. https://doi.org/10.1016/j.frl.2020.101565

- Ma, G., Qin, J., Zhang, Y. (2023). Does the carbon emissions trading system reduce carbon emissions by promoting two-way FDI in developing countries? Evidence from Chinese listed companies and cities. Energy Economics 120, 0140-9883. https://doi.org/10.1016/j.eneco.2023.106581

- Sun, Y., Shen, S., and Zhou, C. (2023). Does the pilot emissions trading system in China promote innovation? Evidence based on green technology innovation in the energy sector. Energy Economics, 0140-9883. https://doi.org/10.1016/j.eneco.2023.106984

- Sun, L., Xiang, M., and Shen, Q. (2020). A comparative study on the volatility of EU and China's carbon emission permits trading markets. Physica A: Statistical Mechanics and its Applications 560, 03-4371. https://doi.org/10.1016/j.physa.2020.125037

- Tan, X., Liu, Y., Dong, H., and Zhang, Z. (2022). The effect of carbon emission trading scheme on energy efficiency: Evidence from China. Economic Analysis and Policy 75, 0313-5926. https://doi.org/10.1016/j.eap.2022.06.012

- Wang, L., Wang, Z., Ma, Y. (2022). Does environmental regulation promote the high-quality development of manufacturing? A quasi-natural experiment based on China's carbon emission trading pilot scheme. Socio-Economic Planning Sciences 81, 0038-0121. https://doi.org/10.1016/j.seps.2021.101216

- Wang, H., Ye, S., Chen, H., and Yin, j., (2023). The impact of carbon emission trading policy on overcapacity of companies: Evidence from China. Energy Economics 126, 0140-9883. https://doi.org/10.1016/j.eneco.2023.106929

- Wu, Q., Wang, Y. (2022). How does carbon emission price stimulate enterprises' total factor productivity? Insights from China's emission trading scheme pilots. Energy Economics 109, 0140-9883. https://doi.org/10.1016/j.eneco.2022.105990

- Yang, S. (2023). Carbon emission trading policy and firm's environmental investment. Finance Research Letters 54, 1544-6123. https://doi.org/10.1016/j.frl.2023.103695

- Zhang, D., Kong, Q., Wang, Y., and Samuel A. V. (2023). Exquisite workmanship through net-zero emissions? The effects of carbon emission trading policy on firms export product quality. Energy Economics 123, 0140-9883. https://doi.org/10.1016/j.eneco.2023.106701

- Zhang, S., Wang, Y., Hao, Y., and Liu, Z. (2021). Shooting two hawks with one arrow: could China's emission trading scheme promote green development efficiency and regional carbon equality?. Energy Economics 101, 0140-9883. https://doi.org/10.1016/j.eneco.2021.105412

- Zhang, Y., Liang, T., Jin, Y., and Shen, B. (2020). The impact of carbon trading on economic output and carbon emissions reduction in China 's industrial sectors. Applied Energy 260, 0306-2619. https://doi.org/10.1016/j.apenergy.2019.114290

- Zhao, X., Lu, W., Wang, W., and Hu, S. (2023). The impact of carbon emission trading on green innovation of China's power industry. Environmental Impact Assessment Review 99, 0195-9255. https://doi.org/10.1016/j.eiar.2023.107040

- Zhou, F., Wang, X. (2022). The carbon emissions trading scheme and green technology innovation in China: a new structural economics perspective. Economic Analysis and Policy 74, 0313-5926. https://doi.org/10.1016/j.eap.2022.03.007